Get the free usaa deposit slip

Show details

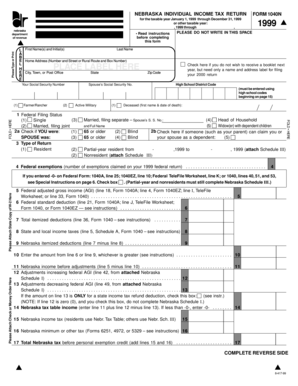

USA Federal Savings Bank 10750 McDermott Freeway San Antonio, Texas 78288-0544 Important Notice Amendment to USA Federal Savings Bank Depository Agreement and Disclosures July 2011 The following revisions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usaa deposit slip pdf form

Edit your usaa deposit slip printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usaa deposit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usaa deposit slip printable pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit usaa direct deposit form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit slip usaa form

How to fill out usaa deposit slip printable:

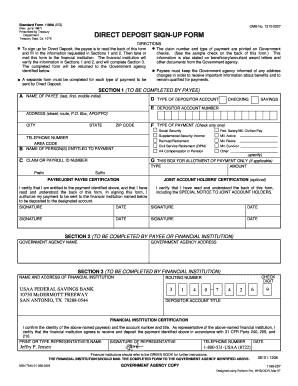

01

Gather all necessary information, including your account number, name, and the date of the deposit.

02

Write the total amount of cash you are depositing in the "Cash" section.

03

If you have any checks to deposit, list each check's amount in the "Checks" section, and write the corresponding check numbers.

04

Add up the cash and check amounts to calculate the total deposit in the "Total Deposit" box.

05

If you want to receive cash back from your deposit, write that amount in the "Cash Back" section.

06

Sign the deposit slip at the bottom to authorize the transaction.

07

Keep a copy of the deposit slip for your records and submit the original to your bank.

Who needs usaa deposit slip printable:

01

Anyone who wants to deposit cash or checks into their USAA account.

02

Individuals who prefer to fill out their deposit information in advance rather than handwriting it at the bank.

03

People who want to keep a record of their deposit and have a physical copy for their files.

Fill

usaa mailing address for deposits

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit print usaa deposit slip from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your usaa direct deposit slip into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get how to fill out usaa deposit slip?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific usaa deposit slips and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in usaa mailing address for check deposits?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your direct deposit form usaa to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

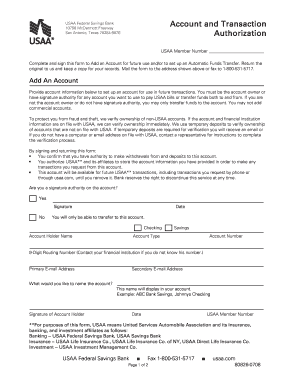

What is usaa deposit slip?

A USAA deposit slip is a document used to facilitate the deposit of funds into a USAA bank account, typically accompanied by checks or cash.

Who is required to file usaa deposit slip?

Anyone who wishes to deposit cash or checks into their USAA account is required to fill out a USAA deposit slip.

How to fill out usaa deposit slip?

To fill out a USAA deposit slip, you need to enter your account number, the amount being deposited, and any details regarding checks included in the deposit.

What is the purpose of usaa deposit slip?

The purpose of a USAA deposit slip is to ensure accurate processing of deposits and to provide a record of the transaction for both the depositor and the bank.

What information must be reported on usaa deposit slip?

The information that must be reported on a USAA deposit slip includes the account number, the amounts of any cash and checks being deposited, and the date of the transaction.

Fill out your usaa deposit slip form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usaa Bank Direct Deposit Form is not the form you're looking for?Search for another form here.

Keywords relevant to blank usaa direct deposit form

Related to usaa direct deposit form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.